When you are climbing up the corporate ladder, it is the last thing on your mind.

When you finally own your first car or piece of property, you are unlikely to think about it.

When you just had your first kid, you still don’t think too much about it.

I’m talking about RETIREMENT.

For many of us, we usually adopt a “It’ll somehow take care of itself” or “My parents are happily retired without having to plan for it” mindset. Retirement only creeps up on you when it’s on the horizon, and at times, when you are most unprepared for a premature retirement.

So how do you start thinking about what your retirement looks like? You might have grand visions of a world trip, or perhaps aim for a “simpler life”. Whatever you envision your retirement to look like, consider the below factors when trying to address the “How much do I need to retire?” question:

-

Determine the age at which you would like to retire (current statutory retirement age in Singapore is 62)

-

Think about the kind of lifestyle you would like to have and estimate the associated cost, including all liabilities you may still have (e.g. housing or car loans). It is important to take inflation into consideration (can you even remember when you last paid only $2 for a plate of chicken rice?).

-

Calculate how much you need to start saving in order to reach your desired retirement fund. Remember, your CPF Retirement Account will support your retirement too.

-

Think about how you can accelerate the growth of your retirement nest by getting higher returns for your money. Depending on your risk appetite and time horizon, you can do this through investments, annuities or endowments. Compound interest is your best friend!

-

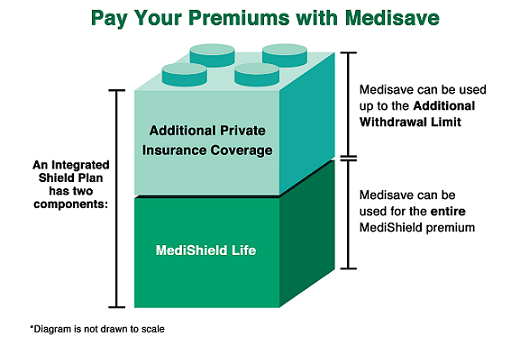

It is critical to assess your insurance portfolio. With rising healthcare costs, any medical bill shocks can seriously derail your retirement plans.

-

Be disciplined about your retirement goals. It is easy to get caught up in instant gratification but every little bit counts in contributing to your retirement plan.

The stark reality is: Many of us enjoy a comfortable lifestyle today and we are unlikely to accept anything less even when we are retired. Furthermore, as our life expectancy increases, our years spent in retirement are likely to increase as well.

It is useful to seek advice from professionals who are well-versed in financial planning. Regardless of the kind of lifestyle you wish to have during retirement, the key is to ensure that you are saving and growing your money today, to meet the needs of tomorrow.

Do yourself a favour: Listen to Einstein, and get started on your retirement plan today.

P.S. I’m Yvonne, your dedicated financial planner. Find Out More …